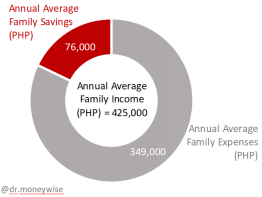

This doughnut represents your life.

Actually, it represents the financial life of an average Filipino household in a year. It shows that a family’s combined savings amount to PHP 76,000, or 18% of their annual income (Philippine Statistics Authority, 2018). Monthly, that’s PHP 6,333 per family.

And that’s just NCR data. In other regions, like ARMM, a combined monthly income of PHP 11,583 will yield a combined monthly savings of PHP 2,333 per family.

Why has it come to this? To understand how the doughnut came to be, we have to understand Filipino behavior when it comes to money.

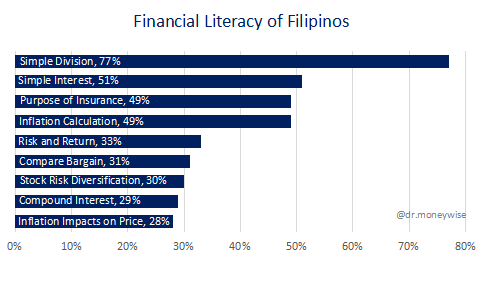

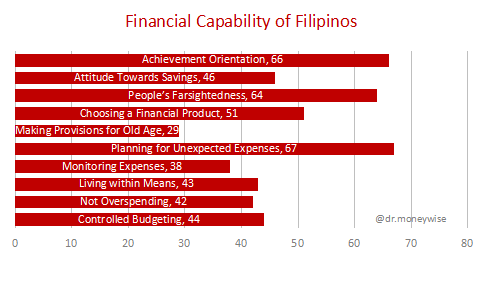

Financial Capability, as defined by World Bank, is “the capacity to act in one’s best financial interest, given socioeconomic and environmental conditions” (World Bank Group, 2015). It is the ability to make sound financial decisions to achieve financial goals, and is made up of your knowledge (literacy), attitudes, skills, and behaviors in money management as well as appropriate use of financial products and services. World Bank’s survey results on the financial capability of Filipinos are shown below.

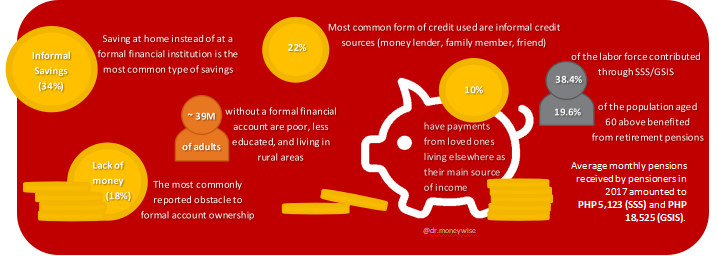

In terms of financial literacy (blue bar graph), Filipino adults are good at performing simple division, but lack the knowledge required to make good decisions on saving and borrowing. These can have serious consequences on long-term savings and wealth accumulation. Also, knowing financial concepts isn’t enough; financial attitude and behavior (red bar graph) can affect financial decisions, too. Most Filipinos are found to have a forward-looking attitude (Farsightedness), the ability to Plan for Unexpected Expenses equivalent to a month’s income without borrowing, and the drive to improve their situation (Achievement Orientation). A lot of us, however, are not so good in areas related to daily money management and long-term planning (World Bank Group, 2015). These results are also reflected on the other findings of the survey, as well as on the 2019 study of the Philippine Statistics Authority (info graph):

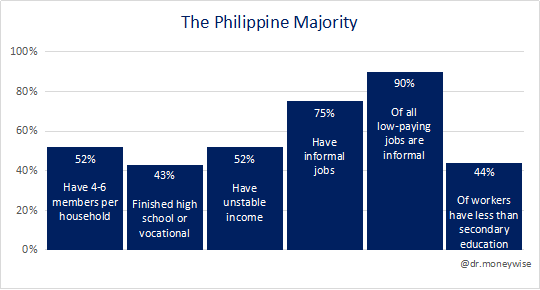

It is clear that the financial literacy and financial capability of Filipinos need some refinement in order to improve the way we handle money. The poverty situation in the country is no laughing matter. Based on the financial capability survey (World Bank Group, 2015) and Rutkowski’s study on employment (Rutkowski Jan J, 2015), below are some factors that contribute to the problem (vertical bar graph):

So, people are poor and they have mouths to feed. Remember the doughnut? It is telling us that saving and budgeting money are important concepts to master in order to improve our lives. For example, having money for education gives us better work opportunities and better income, and it increases our chances for accumulating wealth. In World Bank’s survey, Filipinos who have higher educational attainment and better understanding of financial concepts, as well as greater access to information through a broad range of media (digital, print, etc.) were able to show better scores.

That’s where we come in. Improving financial capability by educating and guiding others is part of what we do, and it can change lives for the better. Our advocacy is for all Filipinos to have financial literacy, financial security, and peace of mind knowing that their future is less uncertain. Who doesn’t want that?

If you want a better doughnut, visit our Solutions page to learn more. If you’re interested in becoming a Financial Advisor, visit our Join Us page instead.

Sources:

Rutkowski, Jan J. 2015. “Employment and Poverty in the Philippines.” World Bank, Washington, DC.

World Bank Group. 2015. “Enhancing Financial Capability and Inclusion in the Philippines – A Demand-side Assessment.” World Bank, Washington, DC.

Philippine Statistics Authority. 2018. “Quick Stat on Autonomous Region in Muslim Mindanao, National Capital Region – June 2018.” Philippine Statistics Authority, Quezon City, Philippines.

Philippine Statistics Authority. 2019. “Decent Work in The Philippines: Statistics on Social Security.” LABSTAT Updates, Vol. 23 No.1. Philippine Statistics Authority, Quezon City, Philippines.